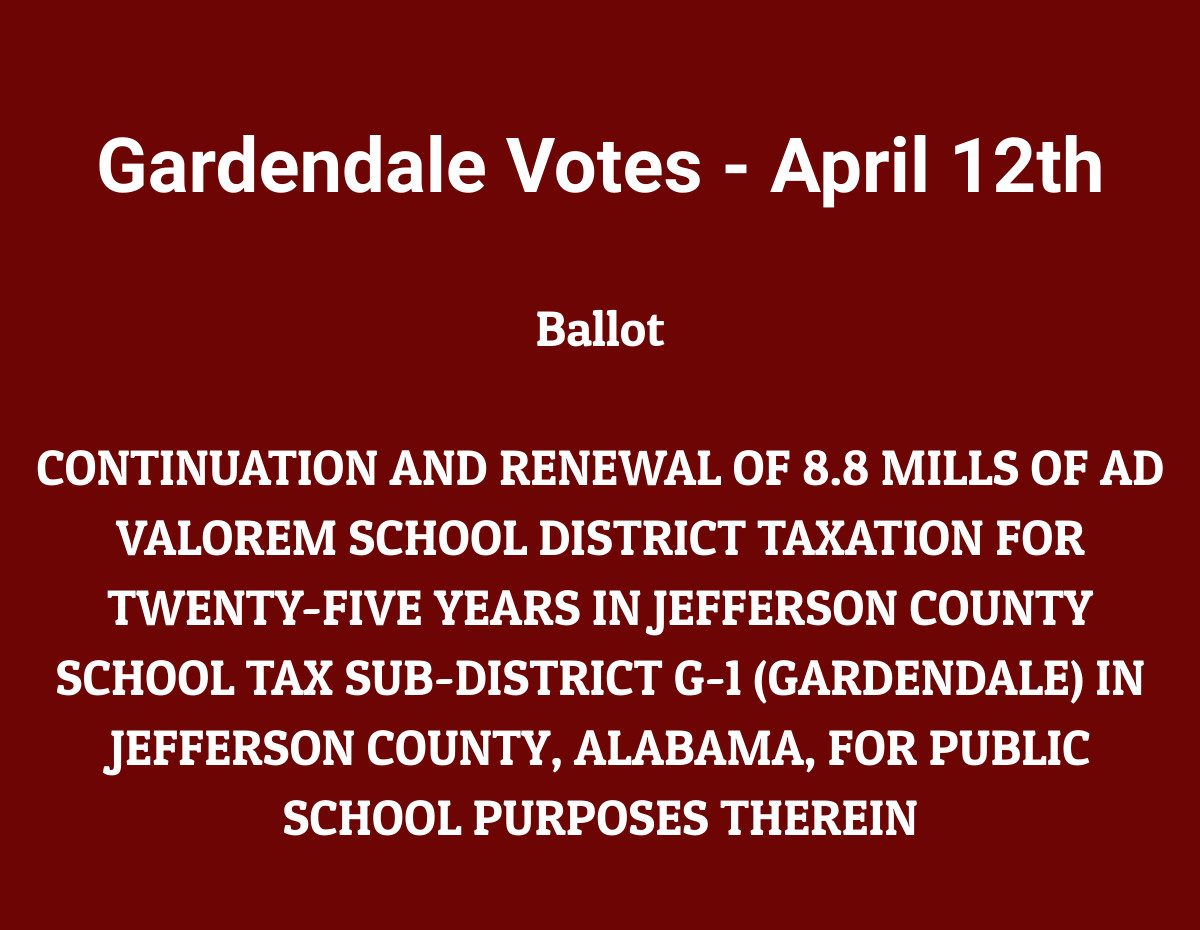

Gardendale Votes on April 12th – Is it a Tax Increase?

This story is muddy. It’s a story of two Alabama State Constitutional Amendments, an Alabama Legislature, county commission and school district that needed to find a way to keep a school tax in place for the Gardendale sub-district by side-stepping